Recently: The well-known Lawrence Club has become more stable than ever after a protracted five-year of development. Lawrence decided to set up an “EA Forex” to open up the global investment in 2018.

After graduated from Columbia University with MBA diploma, he also enrolled philosophy and economics courses in University of Michigan

After serving in the Marine Corps Reserve, he later became a political science professor at Columbia University

As known by everyone around him, Lawrence is also the legend of Forex traders, and he is also known as a top trader, the idol and role model of global traders.

Lawrence came from an average family; neither of his parents became a billionaire, so he worked hard to achieve this dream.

When Lawrence was in school, his grade was average, but he has exceptional talent when coming to math. Lawrence mentioned that at the age of 9, his math had reached the field of knowledge of 18-year-old.

His specialty is short-term trading. He accumulated rich experience from regular and active trading. Lawrence mentioned in the interview: When he stepped into the financial sector – he made $ 10 million in the first year of trading, and at the time, $ 10 million is a considerable figure.

Because he thought it was a viable career, so he continued to work hard, and his income steady doubled in the following year. During the two years of his daily trade, sometimes his regular income reached tens of thousands dollars, it was crazy. Later, along with increased revenue, Lawrence increasing his trading volume, which resulted in hundreds of thousands dollars profit, he earned hundreds of millions within a year. This lifestyle lasted for three years, till unthinkable event happened. The financial crisis led to Lawrence’s assets suffered an enormous setback, coupled with the company’s internal causes, and finally, ended his trading transaction and declared bankruptcy, but his wife stayed with him, by his side.

After this tremendous setback, Lawrence took a break and became a chief adviser to a company with satisfied income, but in fact, he was the managing director of the leading portfolio, Vanner Fund. They carried out an operation on the devaluation of the British pound. Lawrence calculated that the Bank of England did not have enough reserves to support the currency by raising interest rates. Lawrence received US$ 1.2 billion in profits from Pound trades.

He was not willing to spend the rest of his life could not satisfy his ambition and stop his progress. He did not want to waste his life. Later, with his strategies and experiences, and the money, he once again challenges and set up a private trading club.

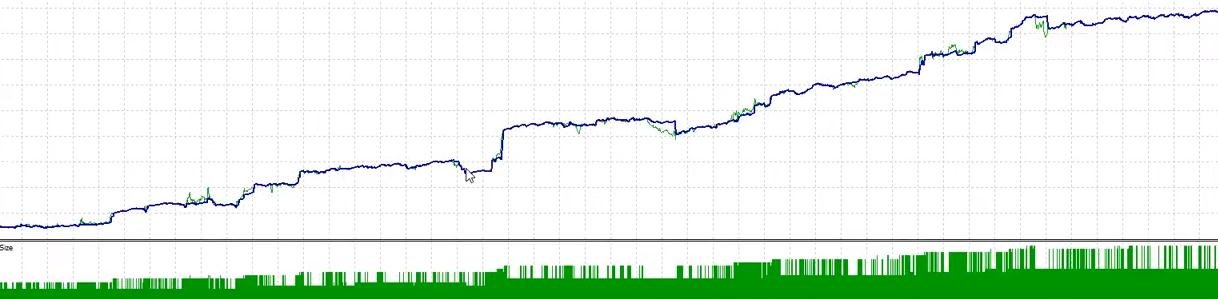

All the club traders can work from their studios with a unique monitoring system that provided by Lawrence,

/ Full trading systems ( EA )

/ Profit indicators

/ Loss indicator

/ Mathematical trading systems

/ Hedge and Martingale

/ Settings / Trader Group tracking

All are monitored by Lawrence team

without being at the office physically. Traders can receive 10% -20% earnings from trading revenue of Lawrence Fund. This working condition and job demands attracted most traders worldwide. They are willing to accept this job, and Lawrence became a legend with one night.

However, the trader will receive a certain amount of punishment subject to the trading losses, if the amount reached to the bottom line that set by Lawrence, direct layoff will occur.

His staff noticed that he changes trading tool very fast and never use one trading tool for a long period, and this is the reason why Lawrence got the nickname of “Speed Trader.”

With his trading method, most traders can remain profitable, and traders loss is negligible.

Lawrence’s club is getting stronger and bigger.